WARREN

Automated Backtesting and Algorithmic Trading

Manually backtesting trading strategies is time-consuming, error-prone, and mostly done with spreadsheets.

Automated backtesting platforms require programming expertise for testing custom algorithms.

Automated trading platforms often fail to meet expectations.

Warren is a no-code solution to trading algorithm development, automated backtesting, and automated trading.

No-Code Development

Build trading algorithms without programming

Automated Backtesting

Test strategies on historical data automatically

Automated Trading

Execute trades automatically with reliable bots

All-in-One Platform

Complete solution from development to execution

Monetization Strategy

Platform access will be free, but users will pay for:

Algorithm/Indicator Marketplace Commissions

Revenue share from algorithm and indicator sales and leases in the user-driven marketplace (Phase 6)

Data Subscription Tiers

Tiered subscriptions for historical market data access based on the amount of data available for backtesting

Backtesting Subscription Tiers or Pay Per Use

Flexible pricing model with monthly subscription tiers for backtesting volume or pay-per-use credits for compute-intensive backtesting runs

API Access Tiers

Tiered API access with higher rate limits, webhooks, and programmatic trading capabilities for professional traders and developers

White-Label Licensing

Enterprise licensing for brokerages, funds, and institutions with custom branding and dedicated infrastructure

Professional Services

Custom algorithm development, onboarding, training, and strategy consulting services

Project Phases

Phase 1: Core Backtesting Engine

Automated backtesting system that processes historical market data and delivers comprehensive result analysis using hardcoded trading algorithms

In ProgressPhase 2: Automated Live Algorithmic Trading

Live paper trading bot executing strategies in real market conditions based on backtested algorithms

PlannedPhase 3: Profitability Trials & Algorithm Tuning

Real-world profitability evaluation and algorithm fine-tuning in live market conditions

PlannedPhase 4: LLM Integration for Trading Algorithm Development

AI integration enabling plain language algorithm description with backtesting for profitability and accuracy assessment

PlannedPhase 5: Multi-User Infrastructure

Scalable platform infrastructure supporting multiple concurrent users

PlannedPhase 6: User-Driven Marketplace

User-developed indicators and algorithms with profitability verification and marketplace for selling or leasing to other users

PlannedProject Schedule

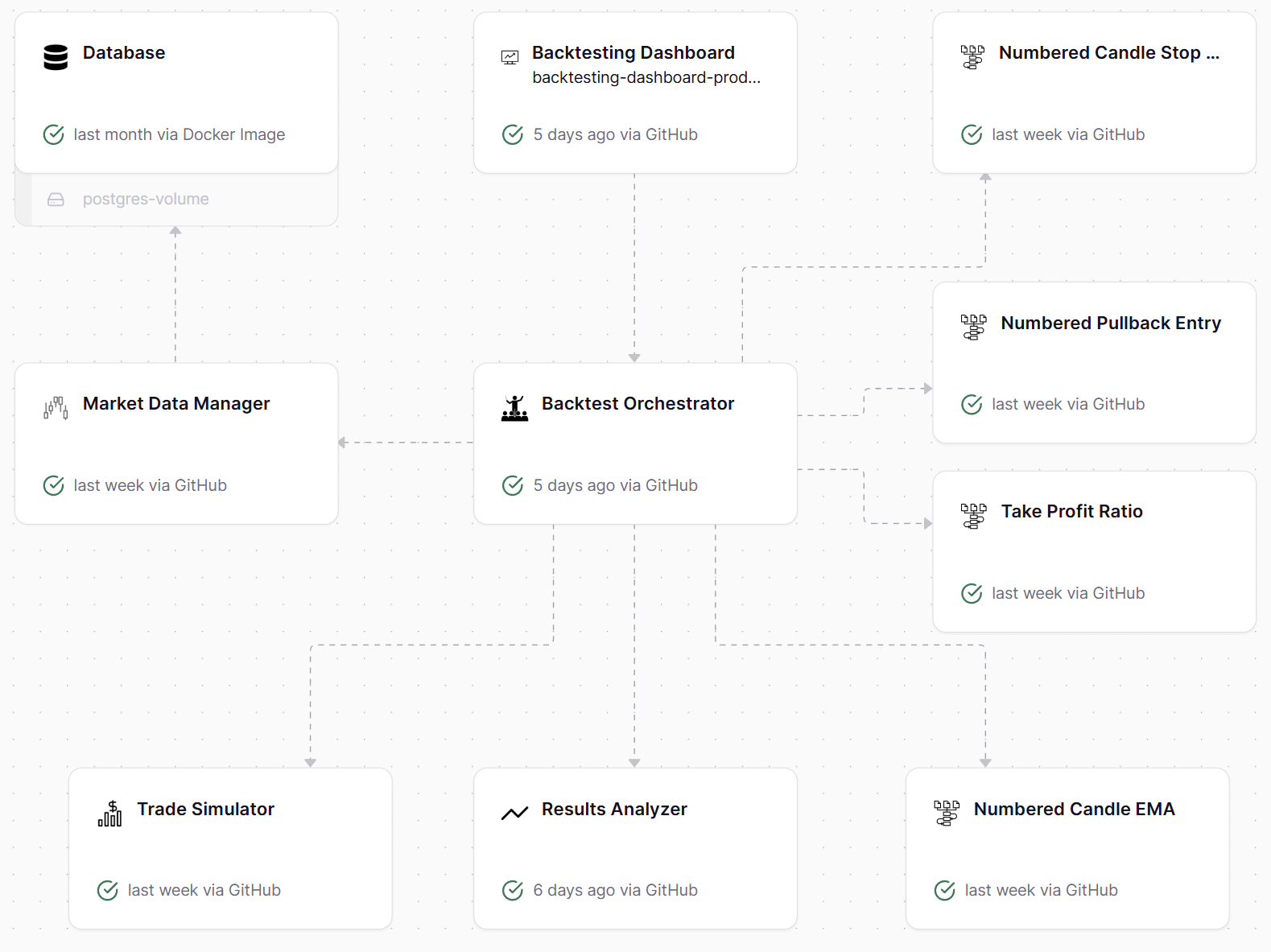

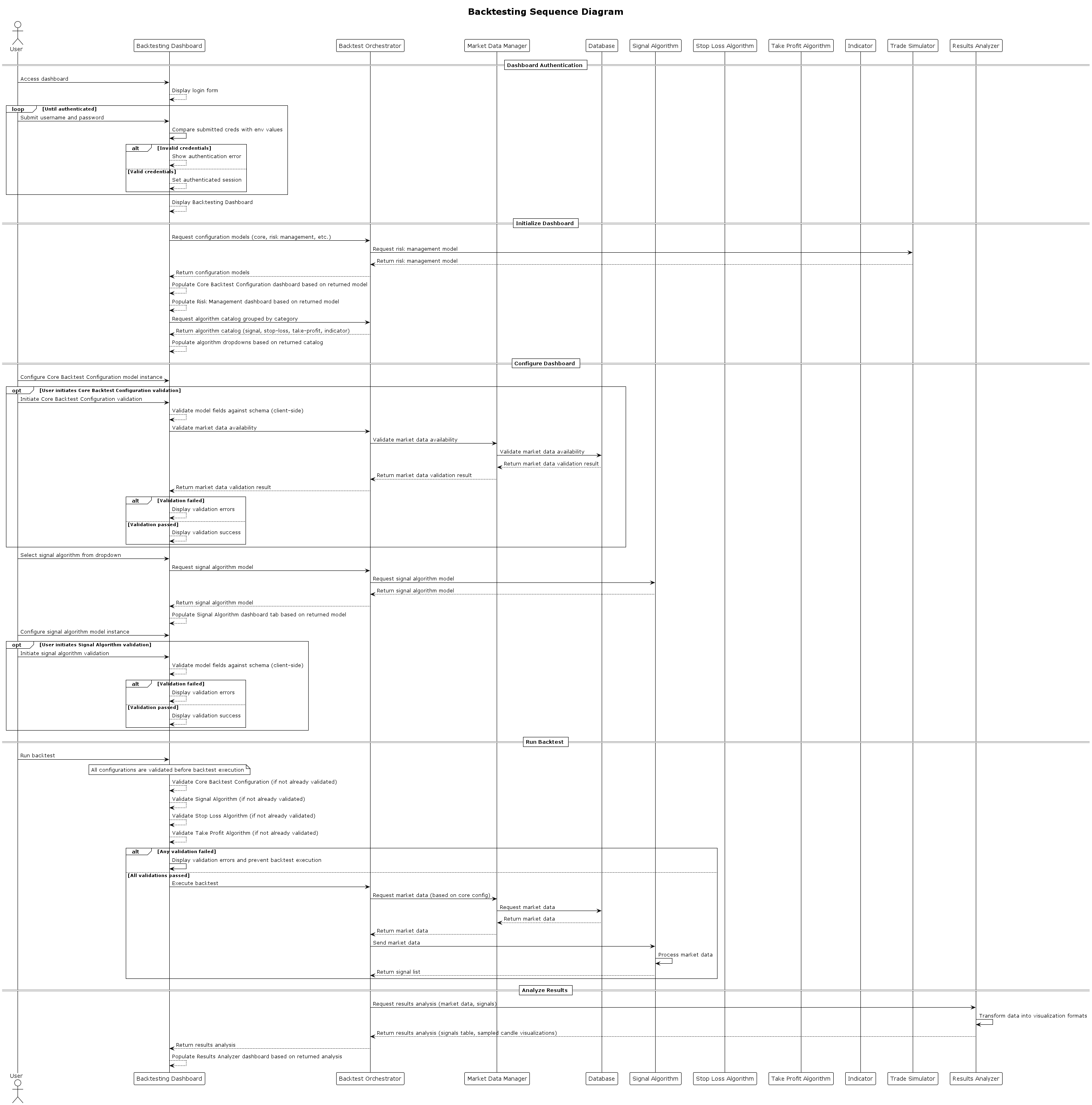

Architecture

- Model-driven microservice architecture

- Deployed on Railway

- Services communicate via FastAPI

- Each service contains a Pydantic model of the data it processes that is accessible by other services via the Backtest Orchestrator.

Where We Are Now

- Warren is deployed to production on Railway

- Test database with limited historical data deployed

- Microservices are communicating successfully

- Backtesting engine nearing completion